- The Morning Block

- Posts

- The Merge Episode

The Merge Episode

The Morning Block: July Edition

Good morning hodlers,

I'm going to start today's edition like every middle school essay: with a definition. Hindsight bias is defined as the tendency for people to perceive past events as more predictable than they actually were.

I think everyone is having a bit of hindsight bias recently when we look at just how overpriced the post-covid bubble had become. Inflation was not "transitory" by any means, and prices do not, in fact, only go up.

It's easy to sulk during these times and get distracted by all the bad news, but that causes you to lose track of all the development happening during this bear market. Today we are going to do a deep dive into the Ethereum Merge, the major upgrade coming to the Ethereum Network later this year, and its impact on crypto as a whole.

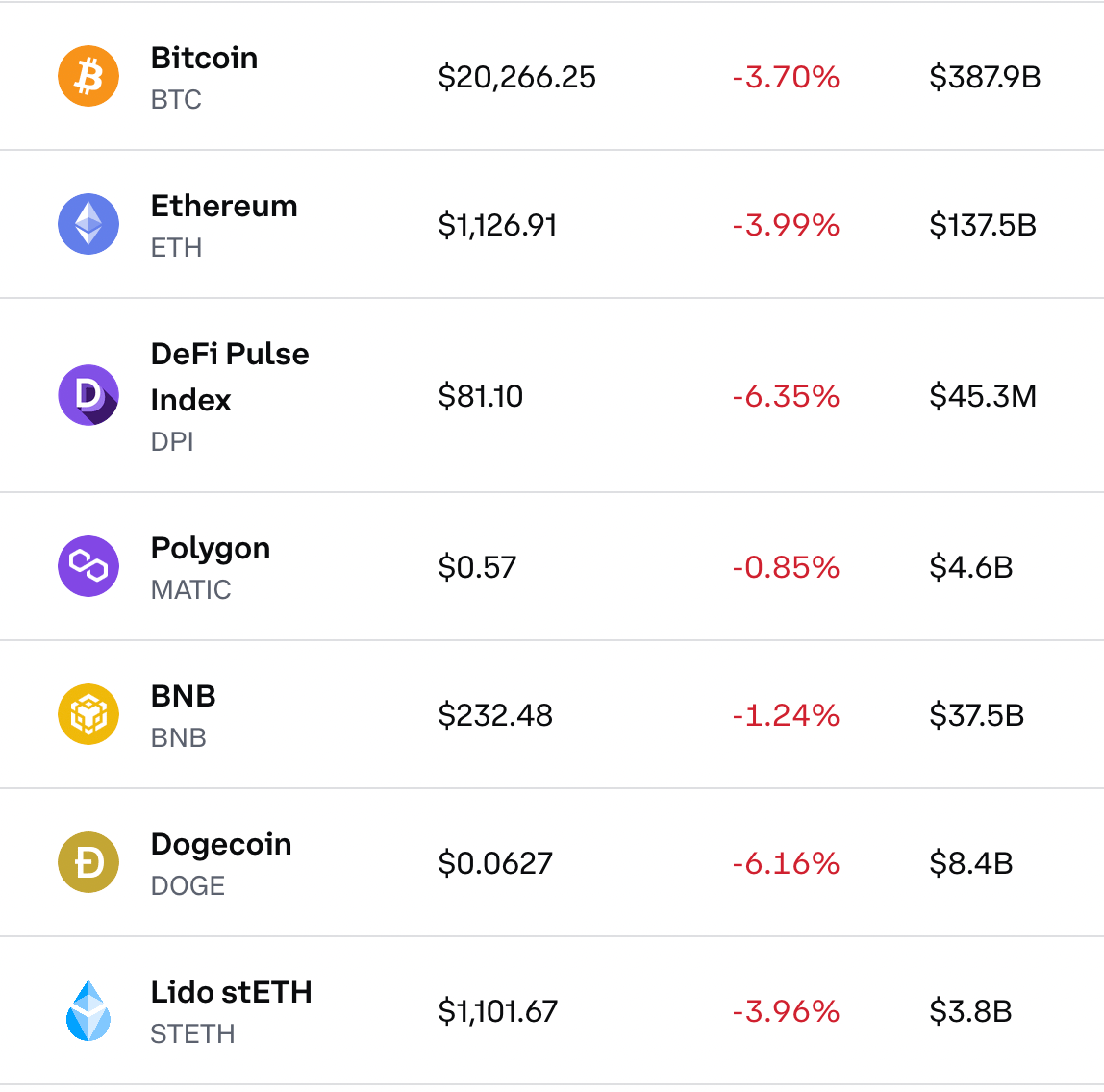

Market Breakdown (07/11/22):

Coinbase

The Transition:

The Merge is the long-awaited, highly-anticipated transition of the Ethereum Blockchain from Proof-of-Work to Proof-of-Stake. That's a dense sentence, so let's break it down further. Proof-of-Work (PoW) and Proof-of-Stake (PoS) are both decentralized consensus mechanisms, meaning they are the means by which the blockchain validates transactions and mines new tokens (where the term mining comes from). The blockchain itself is a digital ledger that serves as an open-source, public record of all transactions made on the network. Transactions are packaged into a block and that block is "mined," or validated, via one of the consensus mechanisms mentioned earlier and added to the... anyone, Beuller, anyone...? Blockchain, that's right.

So Proof-of-Work is a mechanism that operates through miners, or computers far more powerful than the Macbook Air I am typing this on, which compete to mine the new block and receive the issued tokens and transaction fees as a reward. These computers are all doing "work" by using trial and error to guess a complex string of numbers and letters that have no probability of being predicted. Once one guesses correct, that miner generates the new block, receiving the block rewards. All the miners then reach a consensus, extending the blockchain before they quickly move on to guessing for the next block. Due to the complexity and incentives, the blockchain remains secure and decentralized. The threat to PoW is that one with malicious intent could force blocks into the blockchain by producing 51% or more of the mining power, a fairly expensive and energy-intensive feat that is yet to have occurred in Bitcoin tenure.

In the opposing corner, we have Proof-of-Stake (PoS). In PoS, validators, or nodes, explicitly stake Ether in a smart contract and that Ether is used as collateral that can be destroyed if that validator behaves dishonestly, such as supporting the addition of a malicious block to the blockchain. Validators are to PoS as miners are to PoW. A validator is selected at random to propose a new block, sending out to the other validators who cast votes, or attestations, as to the validity of the block. Similarly, all validators will then reach a consensus and the valid block is added to the blockchain. The ease with which one can run a validator allows more people to participate in the security of the network, increasing decentralization. Similar to PoW, Proof-of-Stake is threatened if one makes up 51% of all staked ETH, an extremely expensive attack with strong economic forces preventing it. Proof-of-Stake is often criticized for being more complex than Proof-of-Work. The Merge will be difficult to implement and PoS is a new technology that has only been battle-tested by a few blockchains.

The Merge:

Phew...that was a lot, but we needed it. So what does all this change mean for us as Ethereum users/investors? Vitalik Buterin, the founder of Ethereum, has been researching and planning Ethereum's switch to a PoS consensus mechanism ever since the Ethereum blockchain published its first block in 2015. This event is the culmination of 7 years of research, hard work, and technological advancements I cannot begin to understand. Buckle up and let's get into how it's changing the narrative.

Narrative 1: Bitcoin and Ethereum often get slammed by critics for their energy consumption. The high-powered miners that secure PoW blockchains require a lot of energy. Bitcoin uses more energy each year than the entire country of Argentina, and a lot of that stems from fossil fuels. The validator nodes of PoS can be run from a laptop, and Ethereum's energy consumption is expected to drop by 99.95%.

Narrative 2: Miners are incentivized through the block rewards. It is expensive to operate so many computers with such high energy requirements. To make the energy costs worthwhile and maintain the network security, block rewards need to be incentivizing enough. By dramatically reducing the energy costs with PoS, the cost of security is also decreased. Ethereum's current issuance with block rewards leads to a supply inflation rate of about 4%. After the transition to PoS, that issuance is expected to drop to about 0.11%. Additionally, with the implementation of EIP-1559, a mechanism that burns a portion of transaction fees rather than giving them to miners, last August, Ether could potentially become a deflationary asset. To pay the energy costs, miners often have to sell their rewards and on top of supply increases, there is a large sell pressure on Ether under PoW. This transition will help relieve some of this sell pressure.

Narrative 3: In PoW, only those able to pay for quality computing equipment and energy can participate in mining. With the creation of staking pools with protocols such as Lido (see stETH on market breakdown) and Rocket Pool, everyone can participate in staking Ether to contribute to the security and decentralization of the Ethereum network and reap the benefits. Current staking rewards of stETH are at 4.0% APR and with the complete transition to PoS, all rewards and transaction fees will go to the validators causing this rate to rise to 9-12% according to some estimates.

The Result:

Bull Case: Ethereum as an asset is set to become far more environmentally friendly, relieve almost all systemic sell pressure, and offer a 10% annual return in its currency. With the current burn rate, it can even turn deflationary.

Bear Case: This is an extremely complex endeavor. The Ethereum research team has now run two successful "Test Merges"; however, the last one did have a minor hiccup that was quickly resolved and did not cause any real issues, but there is always a concern. Additionally, crypto continues to be correlated to the tech sell-off.

Again, none of this is to be taken as financial advice. I wanted to learn more about it and thought I would share what I found.

Other Headlines:

Euro and US dollar parity approaches as Euro reaches 20-year low

About $3 billion of Bitcoin could re-enter circulation from the infamous Mt. Gox hack

Sri Lanka has entered into an economic and political crisis

Dutch farmers protest new environmental regulations

Crawley Town FC, also now known as WAGMI United, was acquired and raised $4mm in NFT sales promising NFT owners exclusive Adidas merch and team governing ability

The James Webb Space Telescope released its first image; frankly underwhelming

Elon Musk abandoned the Twitter deal and then turned to Twitter to post memes

Memes: