- The Morning Block

- Posts

- Hard to Keep Optimism

Hard to Keep Optimism

The Morning Block: June Edition

Good late morning hodlers,

Summer is setting in and L2'22 may be starting to open its blinds while investors are closing theirs as the macroeconomic equivalent of a perfect storm approaches.

In today's installment, we'll discuss the current macro picture and get into some technicals and growing opportunities I see coming in crypto. Though things still have space to get worse, I think it's an appropriate time to consider a piece of advice from the Oracle of Omaha himself, Warren Buffett, and have the courage to be greedy as everyone else is fearful.

-The Morning Block

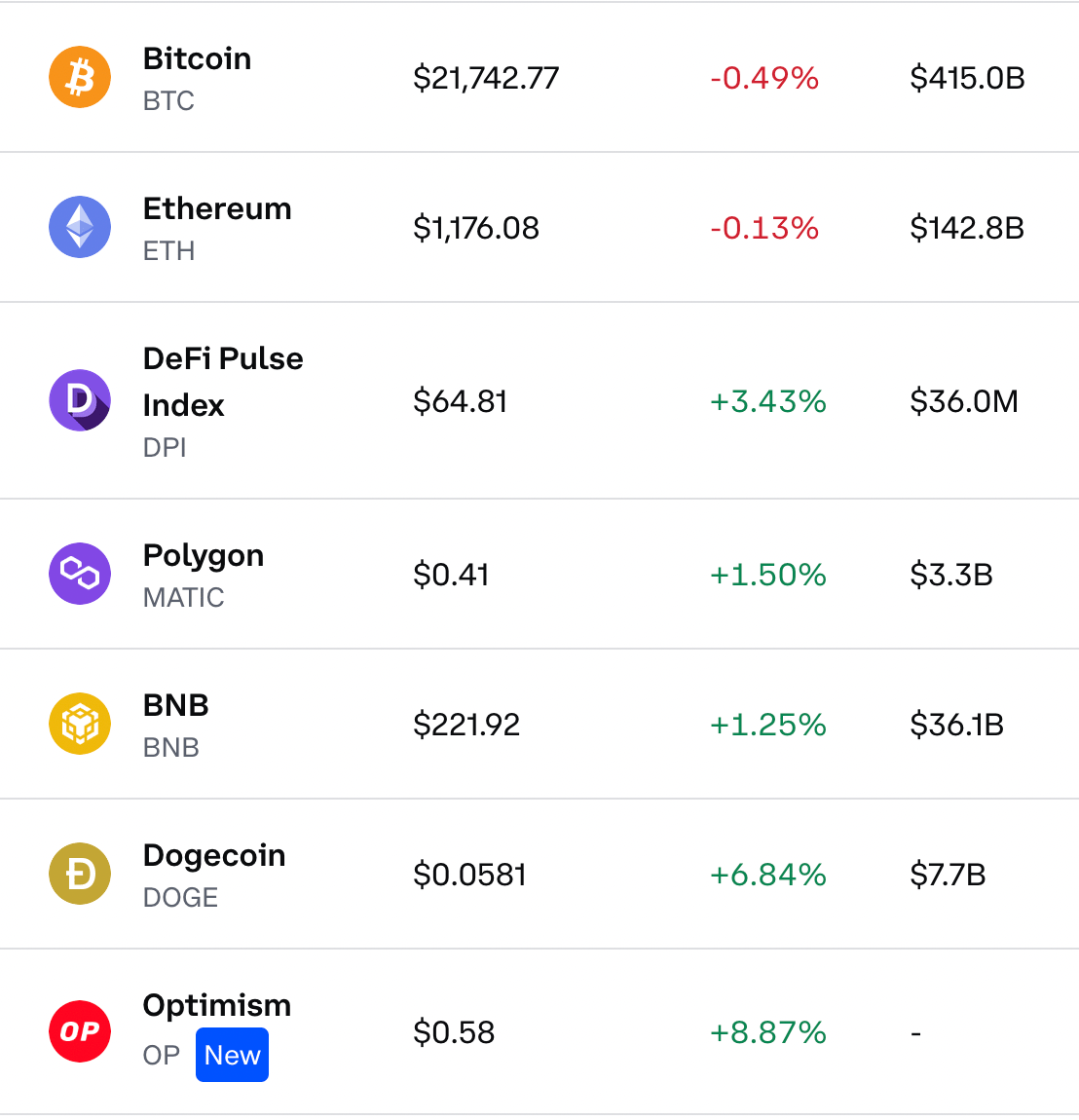

Market Breakdown (06/15/22):

Coinbase

News: Recession? Recession.

For the past month or so the r-word has been creeping its way into company earnings calls, news reports, and about everywhere on Twitter. The May CPI displayed a year-over-year increase in prices of 8.6%, a fresh record for the last 40 years. Just two weeks ago, the stock market's heart and soul, the S&P 500, rose 9% above its lows and tides appeared to have turned. Many got the impression that inflation had peaked, but this fresh report indicates the Federal Reserve is going to have to buckle us in for a ride as they hike interest rates, reduce their balance sheet, and try to slow the economy.

It seems as though the outlook is now only trending in one direction. Former CEO of Goldman Sachs Lloyd Blankfein sees a "very, very high risk" of recession as the market tends to "self-fulfill the prophecy." With the Fed's hawkish stance, many companies have a fight or flight reaction to the possible threat in order to prepare them for a recession, yet these actions also drag us into one. Corporations reduce hiring, households spend more cautiously, and activity slows to the point of a recession. While the Fed tightening may shock the system, unemployment remains at historic lows and there are more job openings than people to fill them. For now, people are just scared, and very few individuals if any know what is to come.

So what do we do? The fact of the matter is that more signals than ever are now pointing to an economic slowdown, and many retail investors, whether it be in stocks or crypto, have not experienced a recession before. There are many ways to prepare for a recession, but as a young investor, recessions can be incredible opportunities. Just as euphoria was at its highest right before the bubble popped, fear is often strongest right near the bottom. In these down markets, not only can one learn lessons on being smarter with investments, but recessions, similar to a crypto bear market (which is also occurring), are chances to sift through the noise and find your true convictions. If you pay attention to the space, the winners will shine through. Numbers don't always go up, but with patience (and a little courage), they should again soon.

Stat: After the bubble of 2000-'01 popped, the Nasdaq did not reach a new all-time high until April of 2015.

Web 3 News: Layer 2 Airdrop Season

The layer 2 ecosystem is quickly heating up and gaining traction among retail investors and crypto participants. Layer 2 scaling applications come in different forms with the most popular being rollups. As I type this, there is just under $5 billion of total value locked on Ethereum's sprawling Layer 2 rollup ecosystem. Remember last year how all of the alternative layer 1 blockchains were blowing up because they provided cheaper fees and faster transactions than Ethereum? Rollups are Ethereum's solution to these issues. Rollups settle the transactions outside of the main Ethereum network but post the transaction data back to the Ethereum blockchain. Allowing for faster and cheaper transactions, while still appreciating the decentralization and proven security of Ethereum.

These new ecosystems are growing at an impressive rate, but crypto has shown there is one proven method for exponential adoption: dropping a token. On May 31st, Optimism, an optimistic rollup on top of Ethereum released its $OP token, which I will discuss later in the newsletter. This airdrop was subsequently followed the next day by an airdrop of $VELO from Velodrome, a new AMM (automated market maker), built on Optimism. If you qualified for the $OP airdrop, you also qualified for $VELO. On top of this, just a few days ago the Hop Exchange, a bridge that allows one to transfer funds across layer 2s and Ethereum, dropped its $HOP token. These airdrops led to a spur of activity on Optimism and other layer 2s to the point where Arbitrum, a fellow optimistic rollup, and Optimism are 4th and 5th among all blockchains in fees over the last week behind only Ethereum, BSC, and Bitcoin.

As you can see, the bear market is not as quiet as one may expect. There is still plenty of action and opportunities. As those of us that received the $OP airdrop know, sometimes all you have to do is explore and test new projects (do your research, of course).

tl;dr/alpha: L2'22 is just getting started and there are plenty of incentives to learn about and try out these new projects. One possible opportunity is Arbitrum, currently the largest layer 2 ecosystem in TVL, Arbitrum is soon beginning an 8-week program called Arbutrim Odyssey, which will promote different projects and opportunities on this rollup to encourage participation. With its rival Optimism having recently dropped a token, it is not crazy to assume Arbitrum is planning something, and participation in the Arbitrum Odyssey may help you be on the receiving end.

Crypto Spotlight: Optimism ($OP)

Today, we're going to take a look at the $OP token recently airdropped to its community by the Optimism Collective. With an initial airdrop of only 5% of the total supply, $OP has a market cap of $119 million and a fully diluted valuation of just over $2.3 billion, at the time of writing, and is down about 70% from its ATH. As I mentioned earlier, Optimism is an optimistic rollup built on top of Ethereum and allows for cheaper and faster transactions while providing the security of the Ethereum blockchain. Rollups are a highly anticipated stage of the Ethereum roadmap that are considered crucial for mass adoption as transaction fees on the Ethereum layer 1 skyrocketed in the last year, raising the barrier of entry for newcomers in the space and making small transactions almost pointless.

The release of the $OP token opened a new chapter for Optimism that helps to decentralize its governance. The token has been dumped by many that received the airdrop (myself included) due to the criticisms of its lack of utility or value accrual. The $OP token only exists on Optimism for now and it is only used for governance, in which holders delegate their tokens' voting power to members of the community that will be active in governance and aligns with their views. So far, not a great sales pitch. However, there is a possible method that I speculate will be introduced that can really change things: decentralizing the sequencer.

The sequencer is the entity responsible for ordering, batching, and submitting transactions to L1 that is currently operated solely by the Optimism PBC. Simply put, the sequencer determines the sequence of transactions that get processed. Imagine there is a line of transactions waiting to be approved. When you pay fees for your transaction, you are paying for a spot in line, and you can pay more to get ahead in line. As the order of transactions is determined, revenue can be taken from these fees and miner extractable value (MEV). Currently, Optimism is reinvesting this revenue into projects on its platform and to promote public goods. Similar to Ethereum's Proof of Stake mechanism coming with the Merge, Optimism can use single-sided staking of the $OP token to decentralize the sequencer and allocate some revenue to the token stakers.

This is not currently the case, which has clearly led to $OP's poor performance during this difficult market, but this short-term mindset may be proven wrong as the Optimism rollup further develops and there's increased adoption.

Headlines

Successful merge of Ropsten testnet moves Ethereum one step closer to PO\S

US Senators introduce a new crypto bill to increase clarity and regulations

Fed hikes rates 75 basis points to combat soaring May inflation

Sudden rise of free-to-mint NFTS

Jack Dorsey's TBD announces web5

The first LIV golf tournament finished with Schwartzel taking home $4 million

Podcast Recommendation: Stanley Druckenmiller on the current state of the economy

Thanks for reading! Not sure how often to keep doing this so feel free to respond and let me know what you think.